Personal Loan Kuching – Fast & Flexible Options with Big Grain Credit

Navigating personal finances in Kuching often presents unexpected challenges. A personal loan offers a flexible, accessible solution without requiring collateral, crucial for those seeking immediate funds. This guide explores what a personal loan Kuching entails, the benefits of choosing Big Grain Credit, and our competitive loan interest rate. We are committed to providing fast, transparent, and tailored loan options for your unique financial needs.

What is a Personal Loan?

A personal loan is an unsecured loan, meaning it requires no collateral like a house or car. Lenders approve these based on your creditworthiness and ability to repay. This makes loans versatile, offering funds for various purposes without asset pledges.

Definition and Overview

A personal loan provides a lump sum repaid over a fixed period with fixed monthly installments and a predetermined loan interest rate. This predictable structure aids budgeting. Funds can be used for almost anything, offering financial flexibility for diverse needs, from small immediate expenses to significant life events.

How It Differs from Secured Loans

The key distinction is collateral. Secured loans require an asset as security, risking repossession upon default. An individual loan is unsecured, meaning you don't risk losing an asset, though defaulting impacts your credit score. While unsecured loans may have a slightly higher individual loan interest rate due to increased lender risk, the benefit of not pledging assets often outweighs this for many borrowers in Kuching.

Common Use Cases (Medical, Bills, Education, Renovation)

A personal loan is highly versatile, suitable for many financial scenarios:

-

Medical Emergencies: Cover unexpected hospital bills for timely healthcare.

-

Debt Consolidation: Combine high-interest debts into one loan with a lower interest rate, simplifying payments and saving money.

-

Education Expenses: Fund tuition, living costs, and study materials for higher education.

-

Home Renovation or Repairs: Secure capital for urgent repairs or planned home improvements.

-

Major Purchases: Finance new appliances, weddings, or significant family events.

-

Travel and Vacations: Manage travel costs by spreading payments over time.

These diverse applications highlight why an individual loan is a popular choice for flexible financial assistance in Kuching.

Why Choose Big Grain Credit for a Personal Loan in Kuching

Choosing the right lender for your loan Kuching is crucial. Big Grain Credit stands out as a trusted and efficient provider, committed to transparent and accessible financial solutions. Our expertise ensures a smooth and beneficial loan experience.

Firstly, Big Grain Credit is a fully Licensed Kredit Komuniti lender. This guarantees our legitimacy and adherence to strict KPKT regulatory standards. Choosing us protects you from predatory practices and hidden fees, ensuring fair and transparent terms for your loan. Your financial safety is our priority.

Secondly, we pride ourselves on fast approval in as little as 20 minutes. Understanding urgent financial needs, our streamlined application and efficient credit assessment provide rapid personal loan approvals. This speed is a significant advantage for those seeking a loan Kuching for emergencies.

Furthermore, Big Grain Credit offers competitive loan interest rates. We strive for affordable and transparent rates, ensuring you know all costs upfront. Our commitment is to offer rates that make your repayment manageable, reflecting our philosophy that necessary funds shouldn't come with overwhelming burdens.

Lastly, we are trusted by thousands across Sarawak and beyond. Our long-standing presence and satisfied customers attest to our reliability and service quality. We've built our reputation on integrity and personalized support, making us a proven partner for your loan Kuching needs.

Types of Personal Loans Available

At Big Grain Credit, we offer diverse personal loan products tailored to various financial needs. Our goal is to provide the perfect loan Kuching solution, whether you need a standard unsecured option or a specialized loan.

-

Standard Personal Loan (No Collateral): Our most popular loan requires no collateral. Approval is based on income and credit history, ideal for general needs like debt consolidation or emergencies. Its unsecured nature makes it fast and accessible.

-

Government Servant Loan: Specialized loan packages for civil servants offer flexible terms and potentially favorable loan interest rates, recognizing their stable employment. This supports those serving the nation with reliable financing.

-

Gold-Backed Personal Loan: For larger amounts or a secured option, use gold as collateral. This allows higher loan amounts with potentially lower loan interest rates, providing a fast way to unlock asset value without selling.

-

Cash Advance Loan: Designed for immediate, short-term financial gaps, this loan offers rapid disbursement. It's perfect for urgent, smaller expenses that cannot wait, providing instant liquidity for true emergencies.

-

Credit Card Consolidation Loan: Combine multiple high-interest credit card debts into a single, manageable loan with a fixed, often lower, interest rate. This simplifies payments, reduces overall interest, and provides a clear path to debt-free living.

Each loan product offers flexibility, catering to specific financial circumstances and ensuring Big Grain Credit remains a comprehensive solution provider.

Personal Loan Interest Rates

Understanding the loan interest rate is paramount when considering any borrowing. At Big Grain Credit, we are committed to transparency, ensuring you have a clear picture of the costs associated with your loan Kuching. Our aim is to offer competitive rates that make your repayment journey manageable and affordable.

Rates from as low as 1.5% per month

We are proud to offer personal loan interest rates from as low as 1.5% per month. This competitive starting rate positions us as an attractive option for borrowers seeking affordable financing in Kuching. It's important to note that this is a starting rate, and the actual loan interest rate offered to you will depend on several individual factors. Our transparent approach means there are no hidden fees or unexpected charges; all costs are clearly outlined before you commit to the loan.

Example Repayment Tables by Amount and Tenure

While we cannot generate dynamic tables in this format, imagine a clear, easy-to-read table on our website that illustrates typical monthly repayments. For instance, a personal loan of RM5,000 at a 1.5% monthly loan interest rate over 12 months would show a specific monthly installment and total repayment amount.

Similarly, a loan of RM10,000 over 24 or 36 months would have different corresponding figures. These tables are designed to help you visualize your financial commitment, allowing you to choose a loan amount and tenure that comfortably fits your budget. We encourage you to visit our website or speak to our loan officers for precise repayment calculations tailored to your needs.

Factors that influence your rate (income, job type, history)

Several key factors influence the individual loan interest rate you are offered:

-

Income Level: Generally, higher and more stable income levels can qualify you for lower loan interest rates, as it indicates a stronger ability to repay.

-

Job Type and Stability: Individuals with stable employment (e.g., civil servants, employees of established companies) are often viewed as lower risk, potentially leading to more favorable rates. Self-employed individuals may need to demonstrate consistent income.

-

Credit History and Score: Your repayment history with other loans and credit facilities plays a significant role. A good credit score, indicating a history of timely repayments, will typically result in a lower loan interest rate. Conversely, a poor credit history might lead to higher rates or even loan rejection.

-

Loan Amount and Tenure: The size of the loan and the chosen repayment period can also influence the rate. Sometimes, larger loans or longer tenures might have slightly different rates.

-

Debt-to-Income Ratio: Lenders assess your existing debt obligations relative to your income. A lower debt-to-income ratio often translates to a better loan interest rate.

At Big Grain Credit, we conduct a thorough yet efficient assessment of these factors to provide you with the most competitive personal loan interest rate possible, ensuring a fair and responsible lending decision.

Eligibility Criteria for Personal Loans

To ensure a smooth application for your loan Kuching, understand our basic eligibility. Meeting these criteria significantly expedites your loan approval.

-

Malaysia Citizen or PR Holder: Applicants must be a Malaysia citizen or permanent resident (PR). This is a fundamental requirement for all our loan products, ensuring compliance.

-

Verifiable Income Source: You must be employed, self-employed, or pensioned, demonstrating consistent income for repayment.

-

Age 18 and Above: All applicants must be at least 18 years old, the legal age to enter financial contracts in Kuching.

-

Satisfactory Repayment History: A good track record of managing past debts is crucial for fast approval loan solutions, influencing your loan interest rate and approval chances.

Meeting these criteria is the first step towards securing your loan with Big Grain Credit. Contact us if you have any questions about your eligibility.

Required Documents for Application

Having all the necessary documents prepared beforehand is key to ensuring a fast approval personal loan process. At Big Grain Credit, we strive to keep our documentation requirements straightforward, allowing for efficient verification and quick disbursement of your loan Kuching.

Here are the standard documents typically required:

-

IC (MyKad) or Passport: A clear copy of your NRIC (MyKad) for Malaysia Kuchings or your valid passport for permanent residents. This is essential for identity verification.

-

Latest 1-3 Months Salary Slips: For employed individuals, providing your most recent one to three months' salary slips helps us verify your income and employment stability. This is a crucial document for assessing your repayment capacity for the loan.

-

EPF Statement: Your latest Employees Provident Fund (EPF) statement serves as additional proof of income and employment history, further strengthening your loan application.

-

Utility Bill for Address Verification: A recent utility bill (e.g., electricity, water, or internet bill) in your name is required to verify your current residential address. This helps confirm your stability and residency in Kuching.

-

Bank Statements (if self-employed): For self-employed individuals, your latest 3-6 months' personal or business bank statements are required. These statements help us assess your business income, cash flow, and financial stability, which are vital for approving your loan Kuching.

Having these documents readily available when you apply will significantly speed up the personal loan approval process, allowing us to provide you with a decision and disburse funds as quickly as possible. Our team is always available to clarify any document requirements.

How to Apply for a Personal Loan

Applying for a loan with Big Grain Credit is simple and efficient. Our streamlined process ensures you get the financial assistance needed without delay.

-

Step 1: Apply online or via WhatsApp. Start your application conveniently online or by messaging our loan officers via WhatsApp for quick guidance. This flexibility makes beginning your loan Kuching journey easy.

-

Step 2: Submit documents. Provide required documents like your IC, payslips, EPF statement, and a utility bill. Having these ready ensures swift verification for loan approval.

-

Step 3: Credit review and offer. Our team quickly reviews your eligibility and income to determine your loan amount and personal loan interest rate. If approved, you'll receive a transparent offer detailing all terms.

-

Step 4: Loan disbursement same-day or next. Once you accept, we prioritize getting funds to you. Most approved applications see same-day or next-day loan disbursement, ensuring immediate access to your loan funds.

Frequently Asked Questions (FAQ)

To address common queries and provide further clarity on our personal loan Kuching services, here are some frequently asked questions:

What is the max personal loan I can get?

Our fast loan approval is efficient. Most personal loan applications see approval as fast as 20 minutes after receiving documents. Funds are typically disbursed the same day. The maximum loan depends on your income and credit. Generally, we offer up to RM50,000 for unsecured options; higher amounts may be available for secured loans.

Can I repay early without penalty?

Yes, absolutely! We offer zero early settlement fees (promo) for individual loan products. You can repay early without penalty, saving on overall interest charges.

Do you report to CCRIS or CTOS?

Licensed Kredit Komuniti lenders typically do not report to CCRIS or CTOS directly. We focus on internal assessment for loan approval.

Is collateral needed for personal loans?

For standard personal loan products, no collateral is needed. These are unsecured loans. We do offer specialized secured options where collateral is required for higher amounts.

Apply Now for Your Personal Loan

Don't let financial uncertainties hold you back. Big Grain Credit provides reliable, fast, and flexible personal loan Kuching solutions. With competitive loan interest rates and transparency, we are your trusted partner for achieving financial goals.

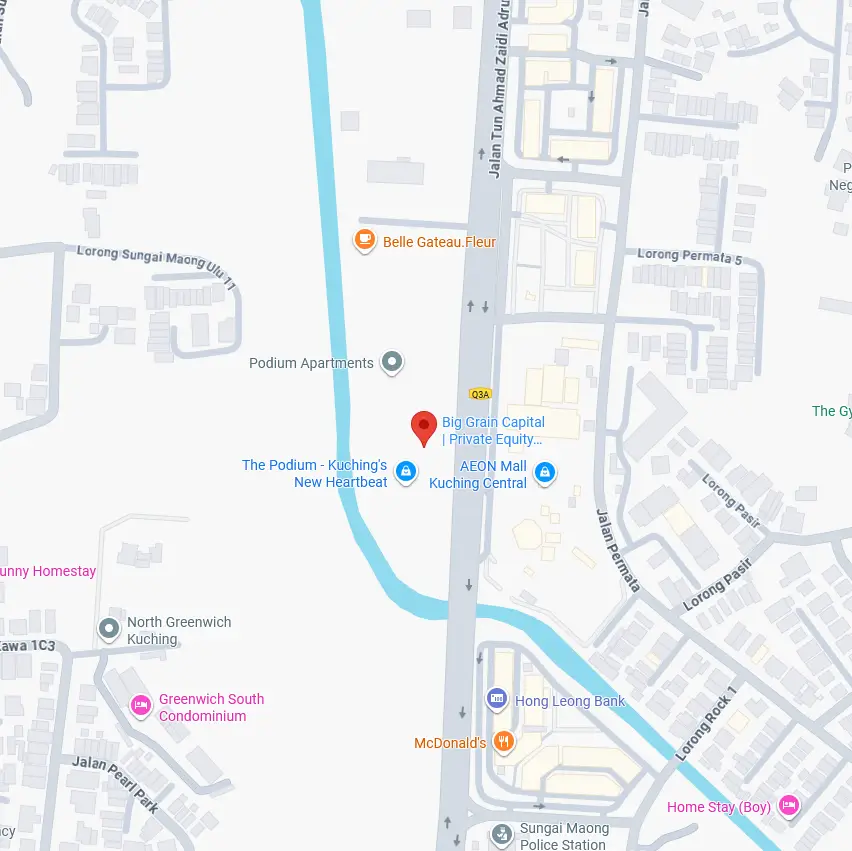

Start your application online now or chat instantly via WhatsApp for quick guidance. Our team offers personalized support. For face-to-face consultation, visit our Kuching office or call our hotline. We're here to assist with your individual loan Kuching application, ensuring a smooth process. Find us easily on Google Maps by searching "Big Grain Credit Kuching." We look forward to helping you secure the loan that suits your needs. Don't wait – take control of your finances today.