Personal Loan for Government Employees in Kuching | Big Grain Credit

For Malaysia's public sector, tailored credit solutions are vital. A government servant loan offers favorable terms due to stable civil service employment. Big Grain Credit specializes in a comprehensive government loan Kuching program, providing fast, flexible, and affordable financing for all civil servants. Our government personal loan options empower your financial journey with competitive rates and a streamlined process.

What is a Government Personal Loan?

A government servant loan is a specialized financial product for Malaysian public sector employees. Unlike conventional personal loans, it offers more advantageous terms due to the inherent stability of government employment, providing flexible financial support for those serving the nation.

Overview of personal loan packages for government workers

Personal loan packages for government workers feature lower interest rates, higher loan amounts, and flexible repayment periods compared to private sector loans. This is due to the stable income and job security of government employment, which reduces lender risk. Big Grain Credit's government loan Kuching program offers competitive, accessible options, often unsecured, ensuring personal loan government employees benefit from their service.

Who qualifies as a government employee (GLC, federal, state, retired)

The term "government employee" for a government personal loan is broad, including:

-

Federal Government Employees: Working for federal ministries, departments, and agencies.

-

State Government Employees: Employed by state-level government bodies and local councils.

-

Government-Linked Company (GLC) Staff: Employees of companies with significant government stakes (e.g., Petronas, TNB, TM).

-

Public University Staff: Academic and administrative personnel.

-

Retired Civil Servants: Individuals receiving a government pension.

This inclusive definition ensures wide access to specialized government servant loan terms.

Benefits over regular personal loans

A government servant loan offers distinct advantages:

-

Lower Interest Rates: Stable government employment allows for more competitive personal loan interest rates, reducing overall costs.

-

Higher Loan Amounts: Consistent income and job security often qualify government employees for larger loans.

-

Easier Approval Process: Stability leads to faster, more straightforward approvals.

-

Flexible Repayment Terms: Options to choose repayment periods that suit your budget.

-

No Collateral Required: Most government personal loan Kuching options are unsecured, simplifying application.

-

Specialized Support: Dedicated teams understand public sector requirements, ensuring a smoother process.

These benefits make government servant loans a highly advantageous financial option.

Why Government Employees Choose Big Grain Credit

Big Grain Credit is a preferred partner for Kuching government employees seeking reliable financial solutions. We efficiently serve the public sector's unique needs, providing unparalleled personal loan government service.

We offer special interest rates for government servant loan, recognizing their stable employment. These preferential personal loan interest rates are highly competitive, leading to lower monthly repayments and significant savings, making our government personal loan truly beneficial.

Big Grain Credit has a high approval success rate for government employees. Public sector employment stability and our payroll system understanding allow efficient assessment, maximizing your chances for a personal loan for government employees. We empower civil servants with deserved financial access.

Understanding urgent financial needs, we prioritize same-day processing and payout for eligible government loan Kuching applications. Our efficient team ensures rapid processing and same-day fund disbursement, providing immediate financial relief without long waits.

We provide government servant loan for public sector applicants. Our specialized team understands the unique requirements for a personal loan government employees may face, offering personalized guidance for a smooth, hassle-free application process.

Big Grain Credit is the ideal choice for a government servant loan due to our specialized rates, high approval, rapid processing, and dedicated support, ensuring a seamless and advantageous financial journey.

Government Loan Kuching – Packages Available

Big Grain Credit offers government servant loan Kuching packages tailored for civil servants, from active employees to retirees. We provide flexible, accessible solutions leveraging the unique advantages of government employment, with competitive terms and transparent conditions.

-

Fixed Interest Personal Loan for Government Staff: Our flagship government servant loan for active federal and state employees. It features a fixed personal loan interest rate for consistent monthly installments, ideal for planned expenses like home renovations or debt consolidation.

-

Pension-Backed Personal Loan for Retirees: Specialized government personal loan options for retired civil servants. This loan uses your stable pension as repayment, making it easier to qualify for funds to manage medical costs or enhance retirement flexibility.

-

Optional Gold-Secured Government Loans: For larger amounts or secured financing, government employees can pledge gold as collateral. This can offer higher loan amounts with potentially lower personal loan interest rates, combining gold loan benefits with civil servant terms.

-

Consolidation Options for Government Credit Card Holders: Our government personal loan includes consolidation to simplify finances. Combine multiple high-interest credit card debts into a single loan with a lower, fixed personal loan interest rate, reducing payments and saving on overall interest.

These government servant loan Kuching packages highlight Big Grain Credit's commitment to advantageous financial solutions for every stage of a government employee's life.

Features of Our Government Loan Program

Big Grain Credit's government servant loan Kuching program is designed for public sector employees, offering attractive and accessible features with optimal terms.

Loan amount from RM1,000 to RM100,000

Our government servant loan offers flexible amounts from RM1,000 to RM100,000. This wide range caters to various needs, from small emergencies to significant investments, reflecting higher eligibility for government employees.

Interest as low as 1.5% monthly

Benefit from highly competitive government servant loan interest rates, starting as low as 1.5% monthly. This preferential rate, a direct advantage of your stable government employment, significantly reduces borrowing costs with transparent pricing and no hidden charges.

Tenure from 6 to 60 months

Choose flexible repayment tenures from 6 to 60 months (5 years). This allows you to tailor your government servant loan to fit your monthly budget and long-term financial goals, whether for quick repayment or lower installments.

No collateral needed for most applicants

Most government loan Malaysia applicants require no collateral. Your stable government employment serves as sufficient security, simplifying the process and ensuring faster approval. This unsecured nature provides hassle-free access to funds. These features collectively highlight Big Grain Credit's dedication to providing a truly advantageous and user-friendly government servant loan in Kuching.

Who is Eligible?

Our government servant loan program serves a broad spectrum of public sector individuals in Kuching, recognizing their stable employment. Eligibility includes:

-

Federal or state government employees: All active personnel in federal or state ministries, departments, and agencies.

-

GLC and public university staff: Employees of Government-Linked Companies and public universities.

-

Armed forces, teachers, police, nurses: Specific essential service providers within the public sector.

-

Retired civil servants with pension slip: Individuals receiving a regular government pension.

Applicants must be Malaysian citizens or permanent residents, and at least 18 years old. While repayment history helps, the primary focus for our government personal loan is public sector employment or pension stability.

Required Documents for Application

For a swift government servant loan application with Big Grain Credit, prepare these standard documents:

-

IC (MyKad) or Passport: For identity and regulatory compliance.

-

Salary slip (3 months): Proof of consistent income and employment stability.

-

EPF or KWAP statement: Additional income and employment history verification.

-

Pension slip (if applicable): For retired civil servants, confirms regular pension income.

-

Utility bill (proof of residence): Verifies current residential address and stability.

Having these documents ready expedites approval. Our loan officers are available to guide you.

Application Process at Big Grain Credit

Applying for a government servant loan with Big Grain Credit is simple and efficient. Our streamlined process ensures you secure your government loan Kuching with minimal hassle.

-

Step 1: Apply via WhatsApp or online form. Start your application by contacting our loan officers via WhatsApp or using our online form for quick guidance and convenience.

-

Step 2: Submit supporting documents. Provide necessary documents like your IC, salary slips, EPF/KWAP statement, pension slip (if applicable), and a utility bill securely online, via WhatsApp, or in person.

-

Step 3: Loan offer review and approval. Our team quickly reviews your eligibility and income stability to determine your loan amount and personal loan interest rate. You'll receive a clear, transparent loan offer upon approval.

-

Step 4: Agreement signing and disbursement. Once you accept the offer, sign the agreement. Big Grain Credit prioritizes same-day disbursement directly into your bank account, ensuring immediate access to your funds.

Frequently Asked Questions (FAQ)

To provide further clarity and address common concerns about our personal government servant loan services, here are some frequently asked questions regarding a government loan Kuching:

What is the max amount I can borrow as a civil servant?

As a civil servant, you benefit from higher loan eligibility due to your stable employment. With Big Grain Credit, you can typically borrow a personal loan government amount ranging from RM1,000 up to RM100,000. The exact maximum amount will depend on your individual income, repayment capacity, and credit assessment. Our dedicated loan officers will assess your profile to offer the highest possible amount that is still manageable for you.

Are retirees eligible for government personal loan?

Yes, absolutely! Big Grain Credit offers specialized government servant loan Kuching packages specifically for retired civil servants. If you are receiving a regular pension, you are eligible to apply for our pension-backed personal loan. Your pension slip serves as verifiable proof of stable income, making it straightforward to qualify for financial assistance even after your active service.

Is a guarantor required for government loan Kuching?

For most of our government servant loan products, a guarantor is generally not required. The stability and reliability of government employment typically serve as sufficient security for the loan. This simplifies the application process and makes it more accessible for civil servants. In rare cases, for very large loan amounts or specific individual circumstances, a guarantor might be considered, but it is not a standard requirement.

Can I repay early without penalty?

Yes, we encourage responsible financial management and flexibility. Big Grain Credit currently offers the benefit of zero early settlement fees (promo) for our government servant loan Kuching products. This means you will not incur any penalties or additional charges if you choose to repay your personal loan government earlier than your scheduled tenure. Repaying early can even help you save on overall interest costs, empowering you to manage your finances more efficiently.

Apply Now for a Government Loan with Big Grain Credit

Don't let financial needs become a burden. As a valued public servant, you deserve access to financial solutions that recognize your stability and contribution. Big Grain Credit is your trusted partner for a government servant loan in Malaysia, offering competitive personal loan interest rates, fast processing, and dedicated support. Secure your government loan Kuching with ease and confidence.

Start your online application for government employees now through our secure and user-friendly portal. Our digital platform is designed for your convenience, allowing you to begin your government personal loan journey from anywhere, at any time. This streamlined process ensures a fast approval government servant loan experience tailored for civil servants.

Prefer immediate, personalized assistance? Contact a civil loan officer via WhatsApp. Our specialized team is ready to provide instant support, answer all your questions, and guide you through every step of the application process efficiently. This direct communication channel ensures you get the clarity and help you need for your personal loan government employees application.

To expedite your application, you can upload documents through our secure portal. This convenient feature allows you to submit all necessary supporting documents safely and quickly from your device, accelerating the verification process for your government loan Kuching.

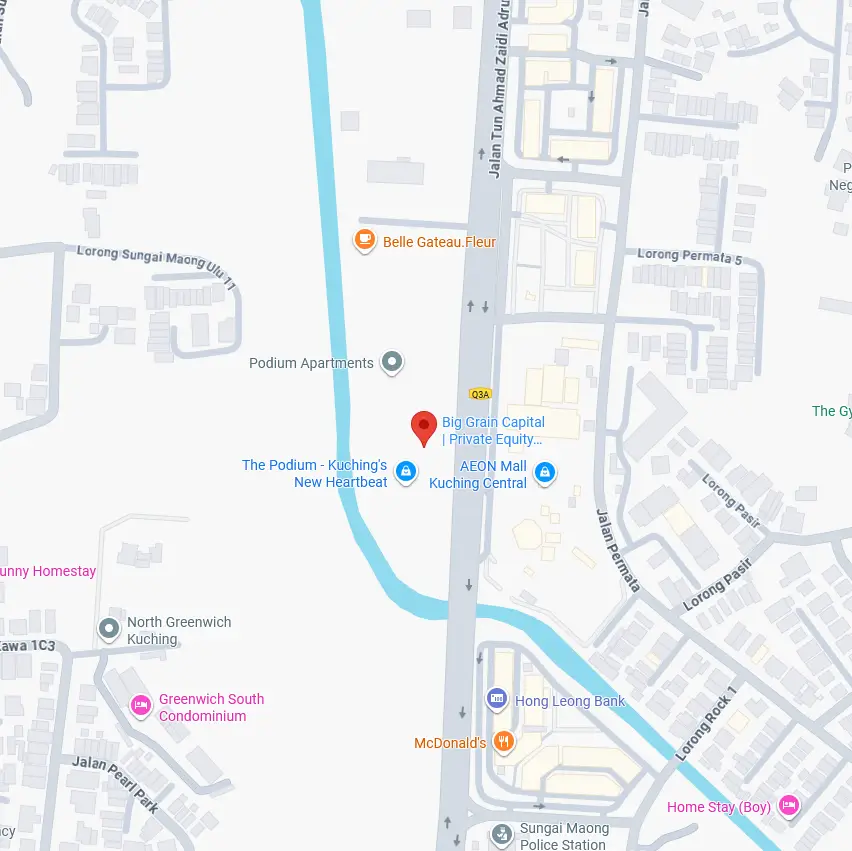

For a face-to-face consultation or to complete your application in person, we invite you to visit our Kuching office. Our friendly and knowledgeable staff will be delighted to assist you, ensuring all your documents are correctly submitted and your queries are addressed. We are committed to making your borrowing experience as smooth and stress-free as possible. Don't wait – take control of your finances today with Big Grain Credit.